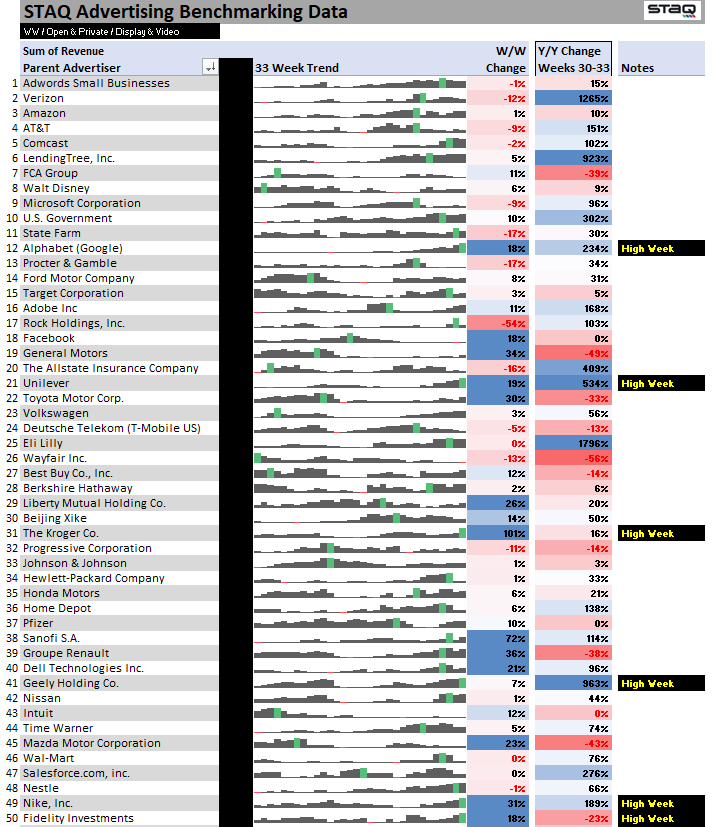

HBO MAXimizes, Biden Spends, CPMs & Revenue Pop

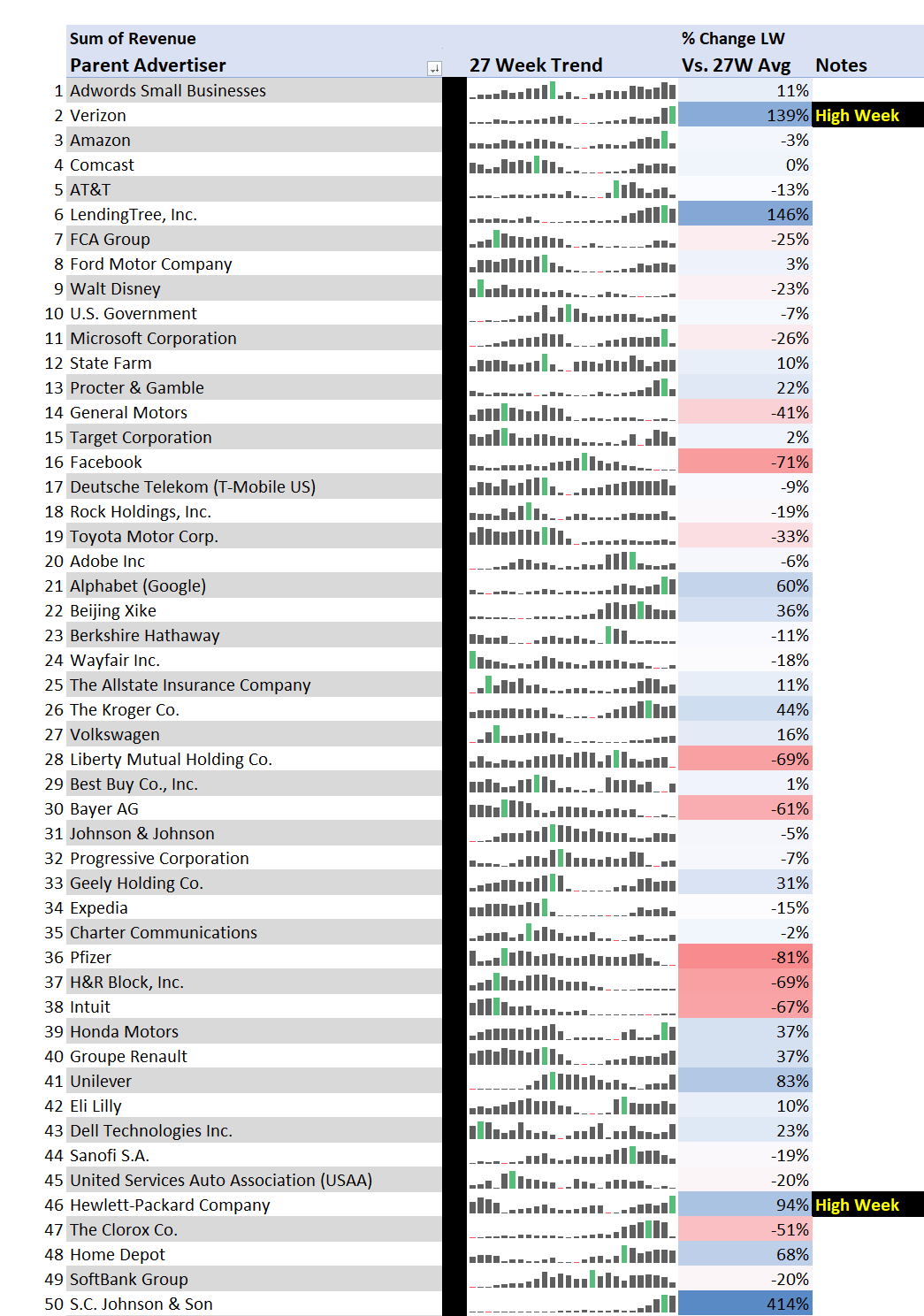

/A Note About the Data: We have been sharing YoY shifts in advertiser spend on a rolling four week basis. Given some of the impressive gains when looking at advertisers like Lending Tree, we want to contextualize these trends relative to the larger dataset and market. For all of the large gainers, there are large decliners as well. The view we share via email contains only the top 50 advertisers who: may have a different product suite to market in the prior year, have recently made a move towards or away from programmatic and we are seeing a resulting share shift, or like many others may be responding to Covid by increasing or decreasing spend. The grand total at the bottom represents the entire Advertiser dataset.

To provide a more comprehensive view, an expanded list of the Top 100 advertisers is below.

Advertiser Data: Biggest Movers

Week 37 had the highest CPMs of the year so far and Revenue up 13%YoY! While this week does encompass part of the slower Labor Day holiday, we saw 27 of the Top 50 advertisers up W/W. Political advertising is starting to pop with Biden and the DNC registering spend. As a baseline is established, we will continue to call out political spend in the weeks to come.

Special Report Available Next Week: Head Start On Q4, A Look At 2019 Top Q4 Advertisers

At A Glance:

Keep on streaming. Time Warner up 14% W/W hits its highest week of the year driven by HBO Max.

After a slow 4 weeks, Verizon up 39% preceding their TracFone announcement this week or maybe ramping up competition with AT&T again.

FCA, Ford, GM, and Volvo (Geely) all up this week driving gains for Vehicle brands.

Below is a view of the top 50 advertisers, based on spend. The right column compares Y/Y trends of the 4 week average of Weeks 34-37 2020 vs 2019. The left column compares W/W trends from Week 37 vs Week 36.

The Grand Total represents the entire Advertiser dataset.